Welcome to MORTGAGE LEADERS

Mortgage Leaders brings extensive lending industry experience and the long-term stability you expect from a reputable mortgage company. Our professional loan experts are ready to guide you through every step of the process—whether you’re buying your first home or you’ve done this a time or two.

About MORTGAGE LEADERS

Mortgage Leaders was founded with a single goal: to make homeownership as affordable and accessible as possible. Over the years, we’ve helped thousands of clients successfully navigate every step of the home-buying and refinancing process.

We specialize in residential lending and real estate financing throughout Los Angeles County, Orange County, and San Bernardino County. With decades of combined experience in the lending industry, we still take pride in what matters most—helping people secure the financing they need to turn their homeownership dreams into reality.

At Mortgage Leaders, we believe in treating our clients the way we would want to be treated: with respect, honesty, dedication, and professionalism. We offer personalized loan application assistance in person, over the phone, or via email, ensuring a smooth and transparent experience from start to finish.

Services

Prequalification

Prequalification is an important first step in your home-buying journey. At Mortgage Leaders, prequalification provides an estimate of how much you may be able to borrow based on the financial information you provide and a credit review.

This step also gives you the opportunity to explore different mortgage options and work with a loan expert to identify the program that best fits your goals and budget.

Common documents needed for prequalification:

.• Most recent 30 days of pay stubs.

.• Credit check authorization.

.• Bank account information or two most recent bank statements.

.• Down payment amount and source.

.• Tax documentation, including W-2s and tax returns from the past two years.

Benefits of prequalification:

Prequalification allows you to shop for a home with confidence, understand your buying power, and be prepared to make a competitive offer when the right property comes along.

Purchasing a Home

We make the home-buying process simple and transparent. Here’s how it works:

.• Complete our quick mortgage pre-approval request

.• Receive loan options based on your unique financial situation

.• Compare interest rates and loan terms

.• Select the mortgage that best fits your needs

We clearly explain the differences between loan programs, helping you make an informed decision—whether you’re a first-time homebuyer or purchasing again.

Refinancing

Refinancing replaces your existing mortgage with a new one. Homeowners typically refinance to lower their interest rate, reduce monthly payments, change the loan term, or access cash from their home’s equity.

Our team will help you evaluate whether refinancing makes sense for your goals and guide you through every step of the process.

Debt Consolidation

A debt consolidation refinance allows you to combine high-interest debt—such as credit cards—into one manageable monthly payment. This option can help lower interest rates, simplify finances, and reduce the risk of missed payments.

Eligible debts may include:

.• Credit cards and retail cards

.• Gas cards

.• Installment accounts

.• Personal loans

With one payment instead of many, managing your finances becomes simpler and more predictable.

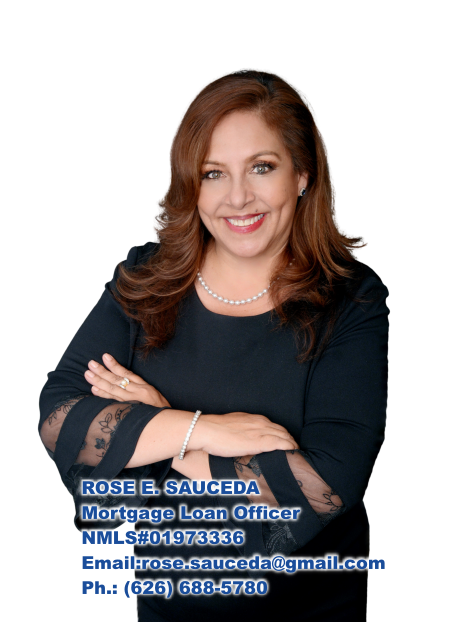

TEAM

At Mortgage Leaders, we believe our work plays an important role in shaping people’s futures. Our leadership team is committed to putting that belief into practice every day throughout the organization. Together, we have built one of the most respected mortgage companies in the area—one with the experience, strength, and integrity to help our clients achieve their homeownership goals.